Find out how MX solutions can help you offer experiences that drive adoption and improve customer engagement.

< Back to case studies

who they are

FormFree is a market-leading provider of the consumer-permissioned asset, employment and income data needed to verify and certify a consumer’s Financial DNA®. Expediting the loan application and origination process, FormFree provides automated verification solutions to consumers, banks, financial institutions, credit card companies, payroll service companies and crowdfunding service providers. The fintech leverages data, years of experience, and patented analytics and algorithms to create valuable products and data-driven intelligence to usher in the new era of transparent, fair and liquid credit markets while making credit more available to the underserved.

Challenge

In 2020, some of FormFree’s users were experiencing long connection times because of multi-factor authentication (MFA) pop-ups. This resulted in a high number of users who cancelled the connection, making it difficult to collect data elements critical to the loan origination process.

Solution

By utilizing MX’s modern connections—tokenized, credential-free API connections built with the highest security standards— on several of its highest-volume financial institution connections, FormFree improved lenders' ability to make more informed decisions about borrowers, minimizing lenders' risk while creating a seamless loan application experience for borrowers. The average aggregation time for FormFree connections decreased by 89 percent to 22 seconds from an average of 3 minutes and 30 seconds, and this change also significantly decreased the number of disruptive MFA pop-ups. By using MX's modern connections to get lenders the necessary data quickly, FormFree has greatly enhanced its customer experience, improving satisfaction and retention.

Empowering Consumers

FormFree’s mission is to create a better home-buying process by enabling creditors to understand a person’s ability and willingness to pay. Like so many others, FormFree founder and CEO Brent Chandler had experienced firsthand the difficulty and stress associated with the loan-application process, and he set out to make loans simpler and safer for everyone.

FormFree leverages MX’s Data Aggregation and Data Enhancement products to automate lenders' verification of applicants’ identity, assets, income and employment. It has helped lenders calculate, verify and quantify what consumers can afford for over $2 trillion in mortgage loans, and since 2018, when its partnership with MX began, FormFree has used MX’s tools to help close more than 1 million loans.

“Buying a house is the single largest purchase most of us will do during our lifetimes—it’s a big deal,” Chandler said. “It’s also invasive. We’re required to collect a lot of documentation, fax it, print it, jump through all those hoops. It can be pandemonium.”

The aim is to replace that pandemonium with the peace of mind supplied by FormFree’s secure, time-saving solutions.

FormFree provides lenders with internal, permissioned digital alternatives to traditional credit scoring and the outdated process of providing paper documentation. Its newest product, called Passport®, gives a full picture of applicants’ Financial DNA®—their assets, income, employment, credit history, identity, liens and judgements, and more—enabling lenders to holisitcally assess their ability to pay.

“The risk in doing a loan with a lender is that you don’t know each other,” Chandler said. “So you have to get to know each other and cross that ocean of risk, and you can do that with Passport®. We’re collecting information and analyzing it with the latest technology to truly understand a consumer’s financial DNA, and then we bundle it up in a blockchain token. This empowers the consumer to understand their purchasing power and ability to pay—and it’s verified, certified, analyzed, and supported by the regulators and lenders.”

Consumers can then, at any given time, pass that DNA on to a lender in order to make a purchase. The process should be as simple as buying a cup of coffee.

“Thanks to our digital solutions, all consumers need to do is provide authorization to their accounts,” Chandler said. “The difference in those experiences is substantial—one is chaotic and overwhelming, while the other is peaceful and serene. Finding a place to call your home, where you’re going to build your future, is a beautiful thing. It should be a happy experience.”

Using API and Token-Based Connections to

Boost Connection Rate

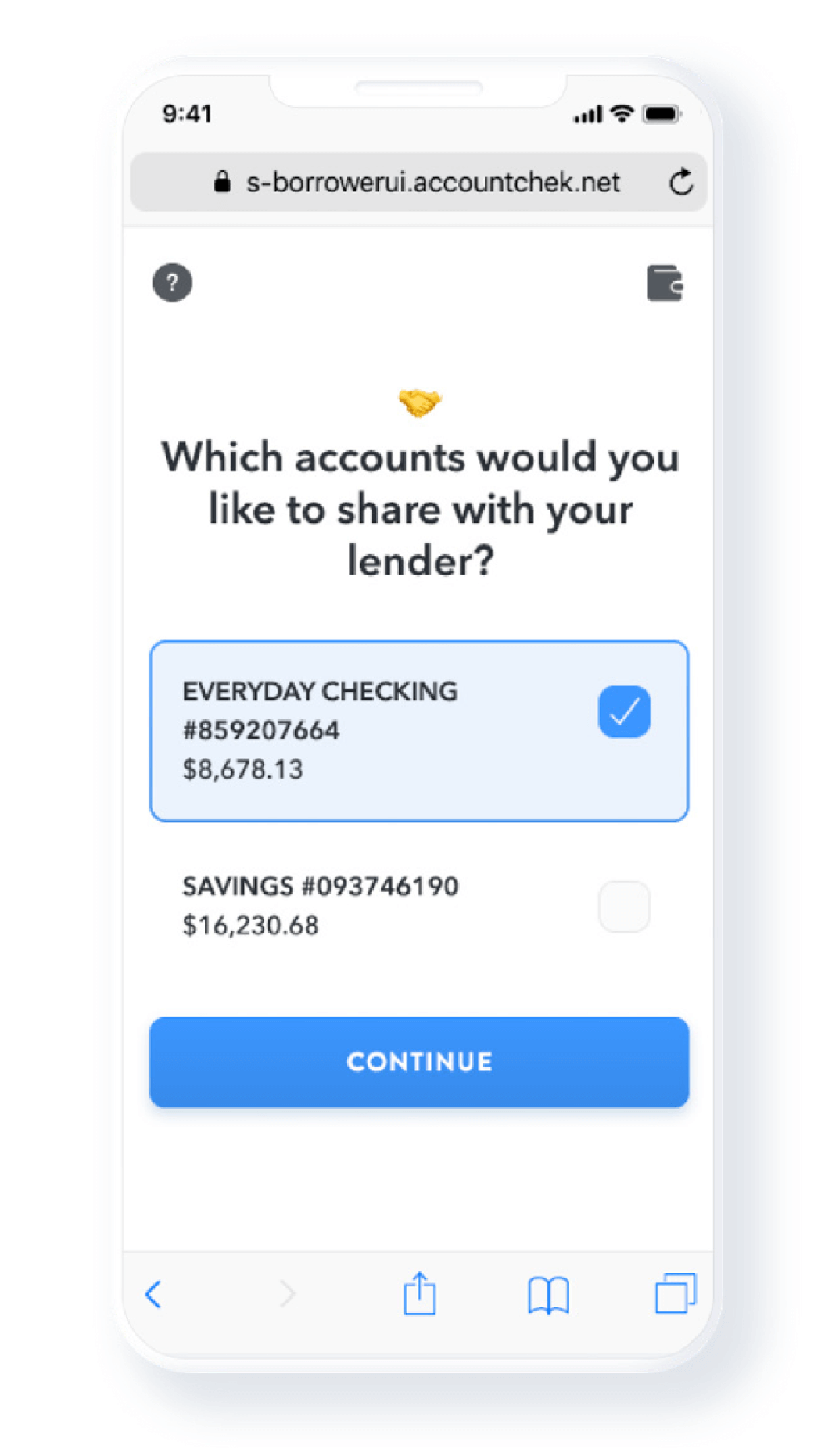

FormFree now works with nearly 3,000 lenders and has integrations with over 100 different platforms as it seeks to transform the industry of direct source data and lending. Many of its products, however, are dependent on consumers granting FormFree access to their credentials. While many consumers have become more accustomed to providing their login credentials, that level of trust doesn’t come easily— and it’s something FormFree doesn’t take for granted.

“You’ve got upward of 75 million people who actively have their credentials enrolled through an aggregation platform of some kind,”FormFree CTO Brian Francis said. “But we’re actually solving a problem and using aggregation to deliver value to the consumer that they can quantify. They know that when they put in their credentials, 45 days later they’re going to be moving into their new house. That benefit alone is one of the biggest drivers as to why consumers have adopted our platform.”

In 2020, however, some of FormFree’s users were experiencing long connection times because of MFA pop-ups. This resulted in a high number of users who cancelled the connection, making it difficult to collect data elements critical to the loan origination process.

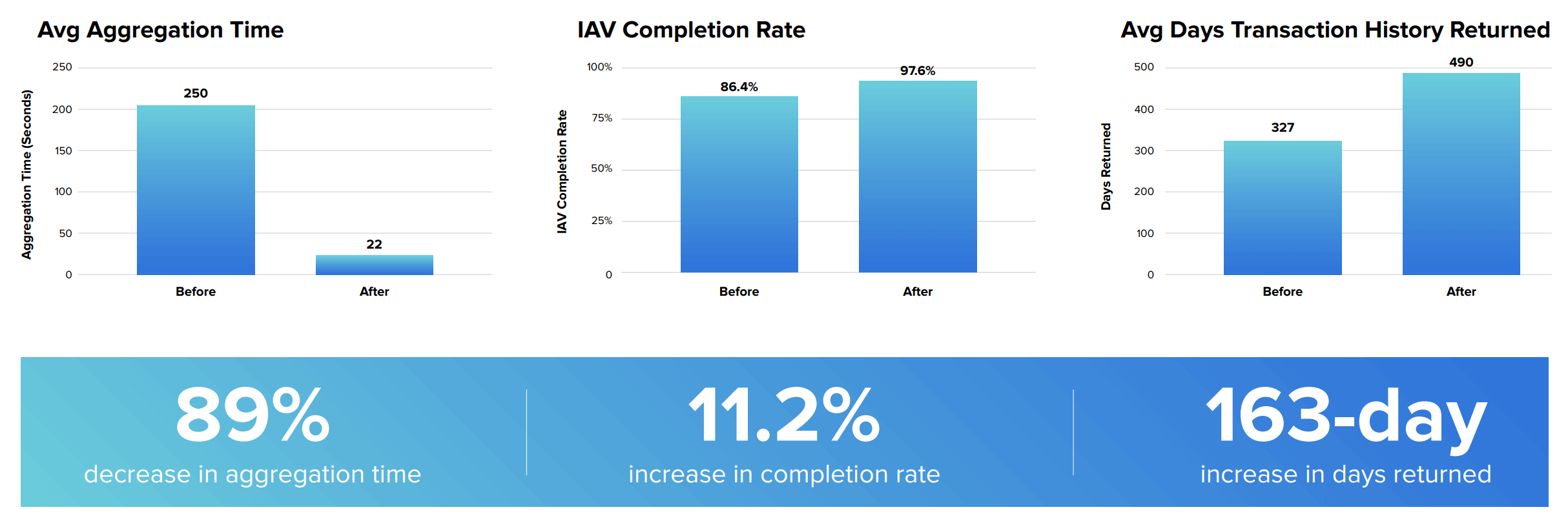

After weighing different alternatives, FormFree decided to utilize MX’s modern connectivity solution and take advantage of MX's tokenized, credential-free API connections to large institutions. By implementing this token-based authorization process, FormFree was able to increase both speed and accuracy—decreasing the average aggregation time for FormFree connections by 89 percent to 22 seconds from an average of 3 minutes and 30 seconds. Using these connections also almost entirely eliminated disruptive MFA pop-ups.

Additionally, FormFree saw the completion rate for Instant Account Verification jobs increase from 86.4% to 97.6% and improved average days of transaction history returned from 327 days to 490 days.

“Our experience with MX's modern connectivity has been world-class,”Francis said. “There haven’t been any MFA triggers when users go to refresh, and we have the security token, so the bank knows we’re allowed access when we ask for a refresh of the data.

We've experienced so many positive outcomes from this rollout, including a huge decrease in the time it takes to complete an aggregation event. We attribute that to MX making the move to API and OAuth-based connections."

“It’s very simple—we have to have a great user experience,” Chandler said.“It has to look good, it has to be fast, and it has to be secure. Of course we go through the banks and lenders to make our services available, but if consumers don’t feel safe providing access to their most sensitive information, then we’ve failed. We take a high level of care to achieve that ultimate professionalism, and we will never cut corners or go back on doing the right thing.”

Conclusion

By using MX's modern connections to help improve its UI and boost its connection rate, and by getting lenders the necessary data quickly, FormFree is further strengthening the level of trust from its customers and improving satisfaction and retention. FormFree anticipates that this improved experience will result in roughly a 15% lift in annual revenue going forward.

download full case study